Understanding Compound Interest: The Eighth Wonder of the World

Compound interest is often called the "eighth wonder of the world," a phrase popularized by Albert Einstein, who recognized its power in wealth creation and financial growth. But what exactly is compound interest, and why does it matter so much? Whether you're saving for retirement, investing, or simply trying to grow your money, understanding compound interest is essential.

This article provides a clear, comprehensive guide to what compound interest is, how it works, its benefits, and how you can leverage it to improve your financial future. By the end, you'll have a solid grasp of this powerful concept and practical ways to make it work for you.

What Is Compound Interest?

Compound interest is the interest earned on both the initial principal and the accumulated interest from previous periods. Unlike simple interest, which is calculated only on the principal amount, compound interest allows your money to grow exponentially over time.

The Basic Formula

The compound interest formula is:

[ A = P \left(1 + \frac{r}{n}\right)^{nt} ]

Where:

- (A) = the future value of the investment/loan, including interest

- (P) = the principal investment amount (initial deposit or loan amount)

- (r) = the annual interest rate (decimal)

- (n) = the number of times interest is compounded per year

- (t) = the number of years the money is invested or borrowed

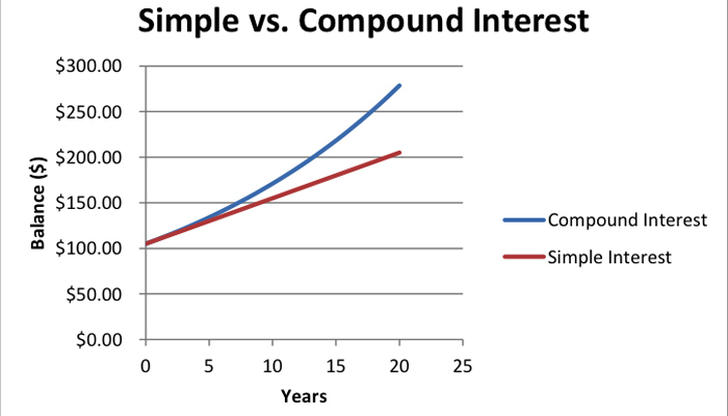

Simple Interest vs. Compound Interest

To understand compound interest better, it's important to distinguish it from simple interest.

- Simple Interest is calculated only on the principal amount. For example, if you invest $1,000 at 5% simple interest annually, you earn $50 each year, and your balance grows linearly.

- Compound Interest means you earn interest on your principal and on the interest that accumulates over time. This causes the growth to accelerate exponentially.

Example Comparison

| Year | Simple Interest Balance | Compound Interest Balance (Annual) |

|---|---|---|

| 1 | $1,050 | $1,050 |

| 2 | $1,100 | $1,102.50 |

| 5 | $1,250 | $1,276.28 |

| 10 | $1,500 | $1,628.89 |

| 20 | $2,000 | $2,653.30 |

As you can see, compound interest grows faster and yields more over time.

How Does Compound Interest Work?

The key to compound interest is that interest is calculated on the total balance at each compounding period, which includes previously earned interest.

Compounding Frequency

The frequency of compounding has a significant impact on how much interest you earn:

- Annually: Interest is added once a year.

- Semi-annually: Twice per year.

- Quarterly: Four times per year.

- Monthly: Twelve times per year.

- Daily: Every day, common in some savings accounts and loans.

The more frequently interest compounds, the faster your money grows.

The Magic of Time: Why Start Early?

One of the most important lessons about compound interest is that time is your greatest ally.

Even small amounts invested early can grow to significant sums over long periods due to the compounding effect. Conversely, starting late means you miss out on valuable growth opportunities.

Example: Starting Early vs. Starting Late

| Scenario | Initial Investment | Annual Interest | Years Invested | Final Amount |

|---|---|---|---|---|

| Start at age 25 | $5,000 | 7% | 40 | $149,745 |

| Start at age 35 | $5,000 | 7% | 30 | $57,434 |

| Start at age 45 | $5,000 | 7% | 20 | $20,466 |

The difference is clear — the earlier you start, the more time compound interest has to work its magic.

Practical Uses of Compound Interest

Compound interest isn't just a theoretical concept; it’s foundational in many financial areas:

1. Savings Accounts and CDs

Banks pay compound interest on savings accounts and certificates of deposit (CDs), rewarding savers with more earnings over time.

2. Investments (Stocks, Bonds, Mutual Funds)

Reinvesting dividends and interest payments causes your investments to grow exponentially.

3. Retirement Accounts

401(k)s, IRAs, and other retirement accounts benefit immensely from compound interest, especially when contributions start early.

4. Loans and Credit Cards

Compound interest also works against you when borrowing money. Credit cards, payday loans, and some mortgages compound interest, increasing how much you owe over time if not paid promptly.

How to Maximize Compound Interest Benefits

1. Start Saving and Investing Early

Time is crucial; the sooner you start, the greater the compound effect.

2. Make Regular Contributions

Consistent deposits increase the principal, accelerating growth.

3. Reinvest Earnings

Always reinvest dividends, interest, or returns instead of cashing out.

4. Choose Accounts with Frequent Compounding

More frequent compounding means faster growth.

5. Be Patient and Avoid Early Withdrawals

Compound interest requires time to work; withdrawing funds early can reduce your gains.

Common Misconceptions about Compound Interest

- "Compound interest guarantees huge profits" — While powerful, returns depend on interest rates and time.

- "More compounding frequency always equals big gains" — The difference between monthly and daily compounding is often minimal for typical accounts.

- "It only works for big investments" — Even small, regular savings can grow significantly.

- "Compound interest applies only to savings" — It also affects loans, so understand how your debts accumulate interest.

Real-Life Example: The Power of Compound Interest Over 30 Years

Imagine investing $200 monthly at an annual interest rate of 7%, compounded monthly.

- Initial investment: $0

- Monthly contribution: $200

- Interest rate: 7% annually

- Investment duration: 30 years

Using the compound interest formula for recurring deposits, the investment grows to about $199,000.

Had you invested the same $200 monthly for only 20 years, it would grow to approximately $82,000—less than half the 30-year amount. This clearly shows how time combined with compounding boosts growth.

Risks and Considerations

While compound interest can help grow your wealth, there are things to watch out for:

- Interest Rate Changes: Investment returns and loan interest rates can fluctuate.

- Inflation: It can erode the real value of your returns.

- Fees and Taxes: Investment fees and taxes reduce net growth.

- Market Risks: Investments in stocks or funds are subject to market volatility.

Always consider these factors and consult financial advisors as needed.

Conclusion

Compound interest truly deserves its reputation as the "eighth wonder of the world." It transforms small, consistent investments into significant wealth over time. Understanding how it works and applying smart saving and investing strategies can set you on a path to financial security.

Whether you're saving for retirement, a major purchase, or simply building your financial cushion, leveraging compound interest is one of the most effective tools you have. Start early, contribute regularly, and watch your money grow exponentially.